Akbank

Strategy/UX/Prototyping . www.akbank.com

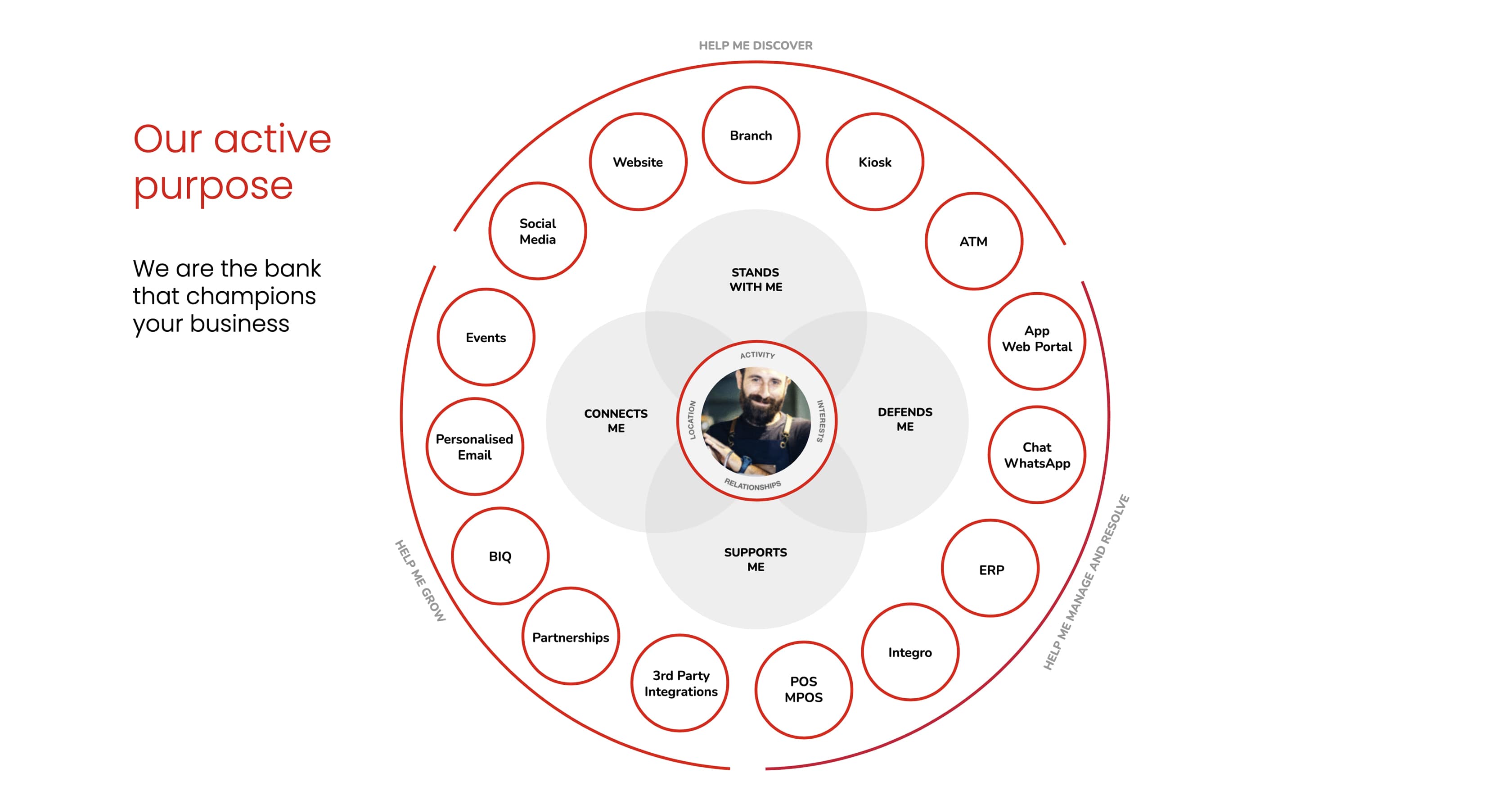

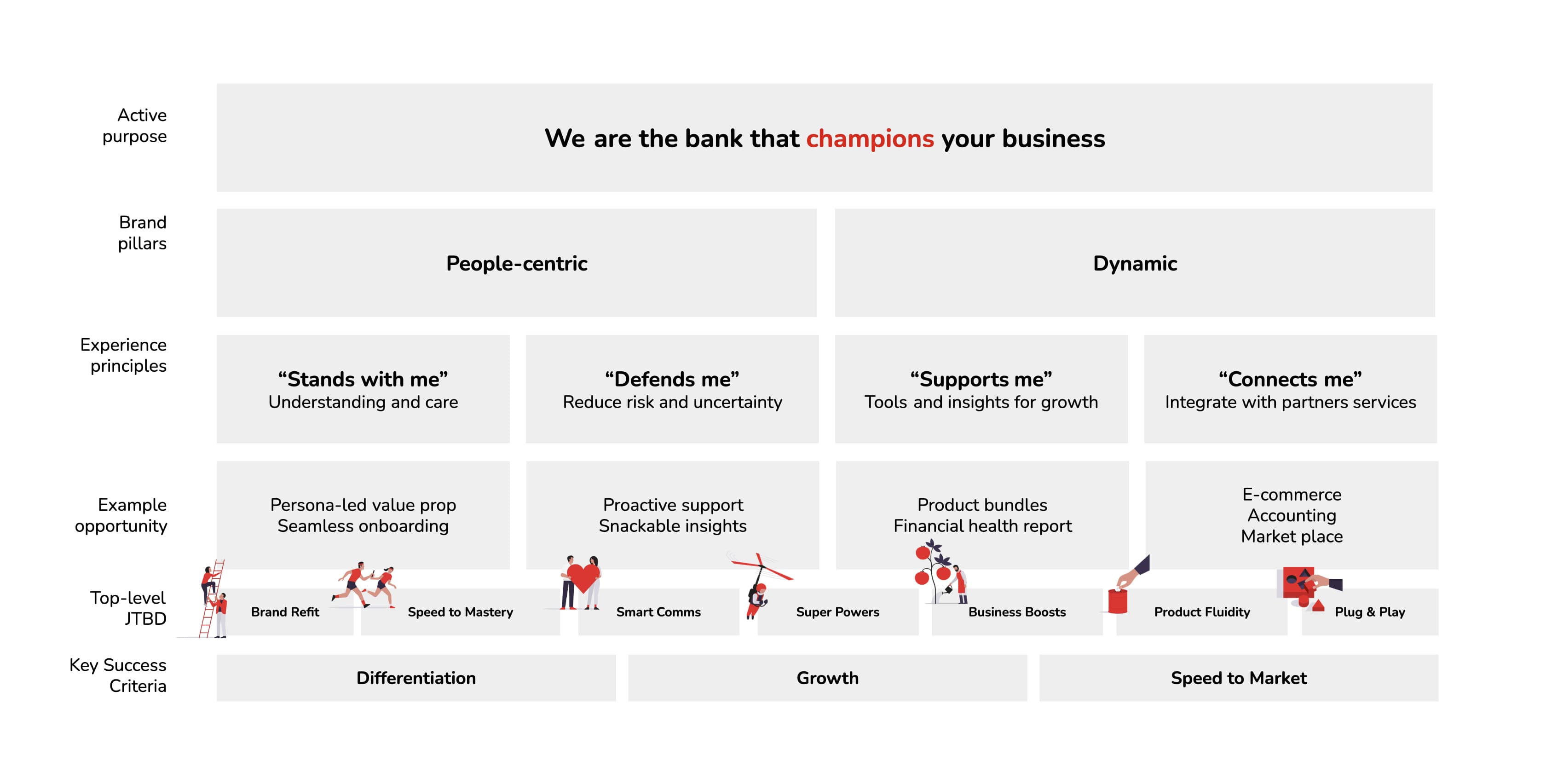

Akbank approached R/GA to help them move towards a vision that brings Akbank together as one brand, one platform and one experience for its customers.

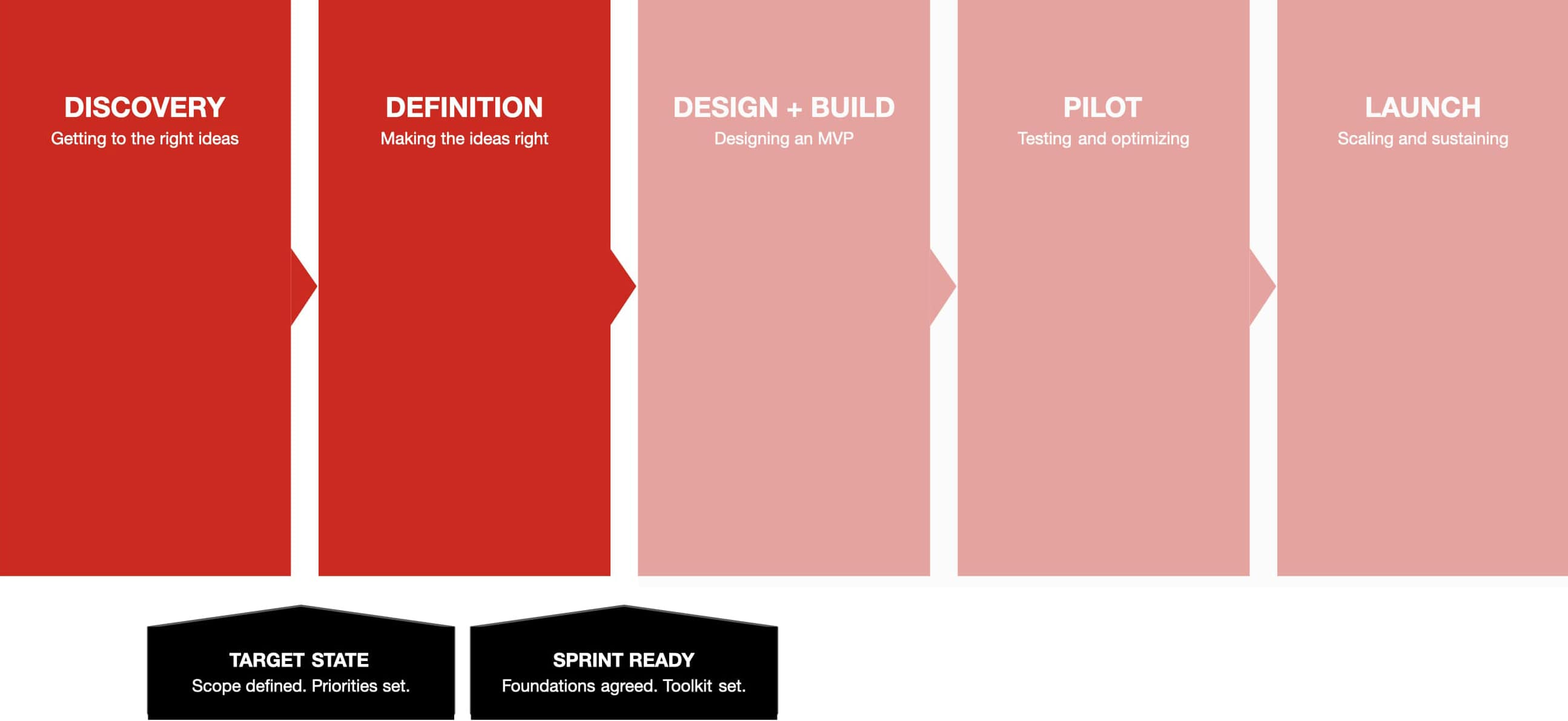

We took an approach with a series of structured phases to identify Akbank unfair advantage to ensure a successful product market fit. To help us achieve that we focused on the 2 first phases of the product creation, Discovery (Getting to the right ideas) and Definition (Making the ideas right).

DISCOVERY PHASE

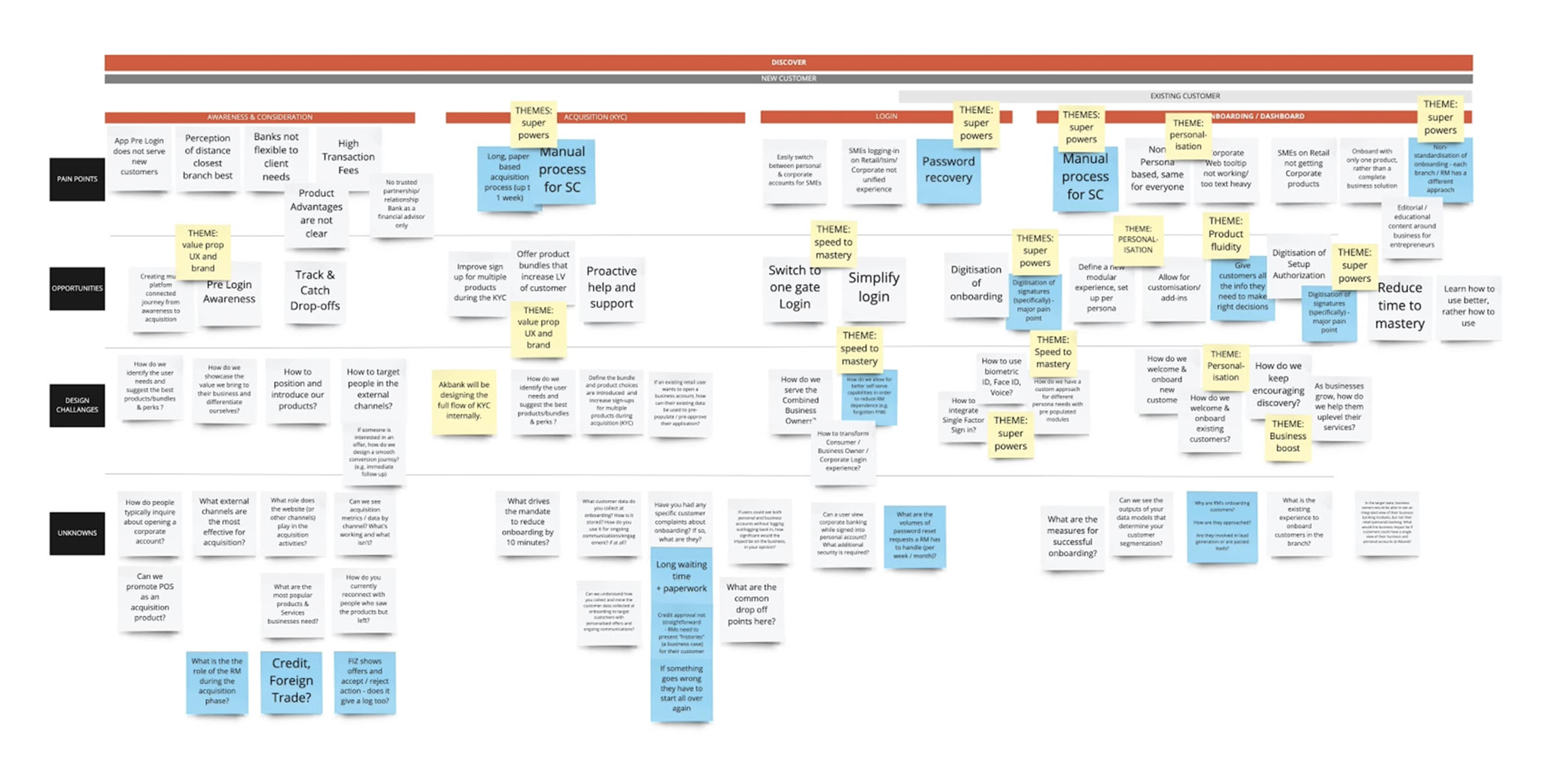

We leveraged a range of inputs from Akbank and Oliver Wyman (Research team), using the Jobs To Be Done methodology, in order to arrive at a shared vision for the target state.

Customer-centric vision > Understanding Jobs To Be Done > Prioritising Jobs To Be Done

We conducted an Ecosystem Audit

We started by assessing the As-Is state across Akbank Corporate Internet Banking and Mobile App. Doing that, helped us identify elements that work well and uncover areas for improvement. We were then able to compare it with our competitive benchmark.

We analysed Competitive Benchmarks

We took some time to find Best in class examples from banking and financial services. It helped us identify the features and services that are meeting or exceeding user expectation as well as identify elements that are basic “must have” functionality and other differentiating moments where Akbank can shine.

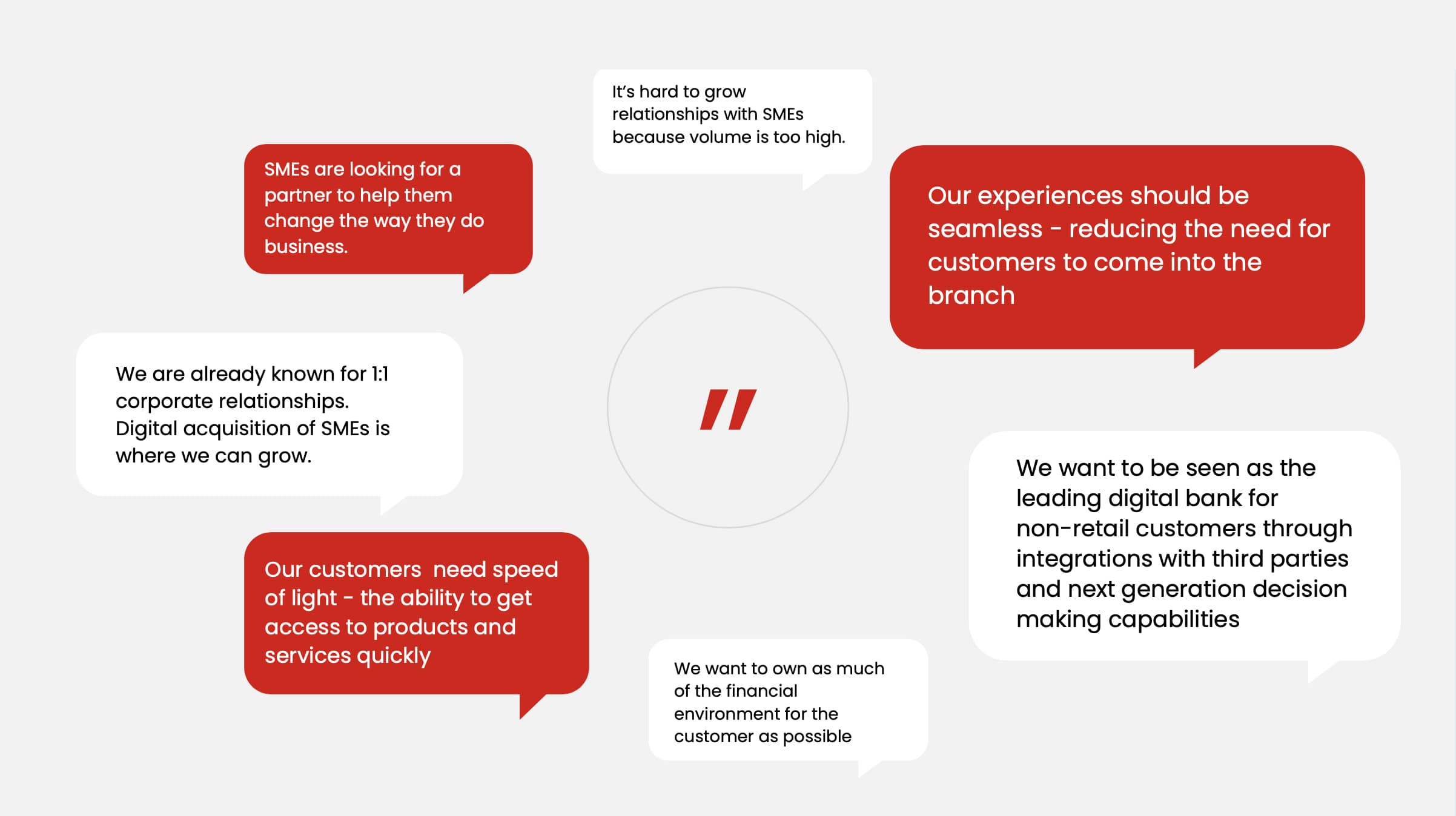

We interviewed Stakeholders

To understand the business ambition and key priorities for non-consumer digital transformation we talked with some of Akbank's stakeholders. We uncovered deeper customer challenges in market as well as opportunities to solve challenges and create meaningful moments.

Interrogated User Research

We reviewed Oliver Wyman personas and project charters, Ethnography reports, interview scripts, and User stories to gaine deeper insight into who our users are, what they need, and what they wish for. After this exercise, we identified relationship manager pain points, needs, and ambitions to address in the designed experience.

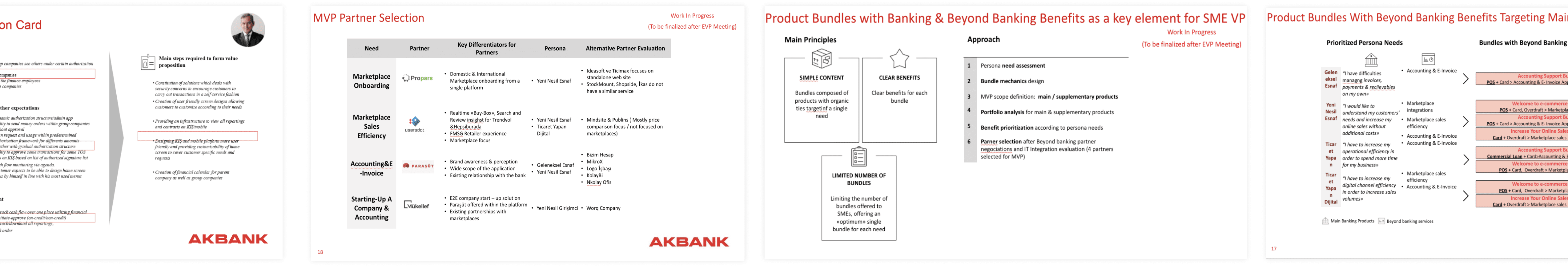

Studied Value Props, Product analysis and Partnerships

The next step was to focus on delivering the right products and services at the right time on the journey. To do so, we identified differentiating moments to highlight in the designed experience and Integrated product bundles and partnerships at appropriate moments within the connected journey.

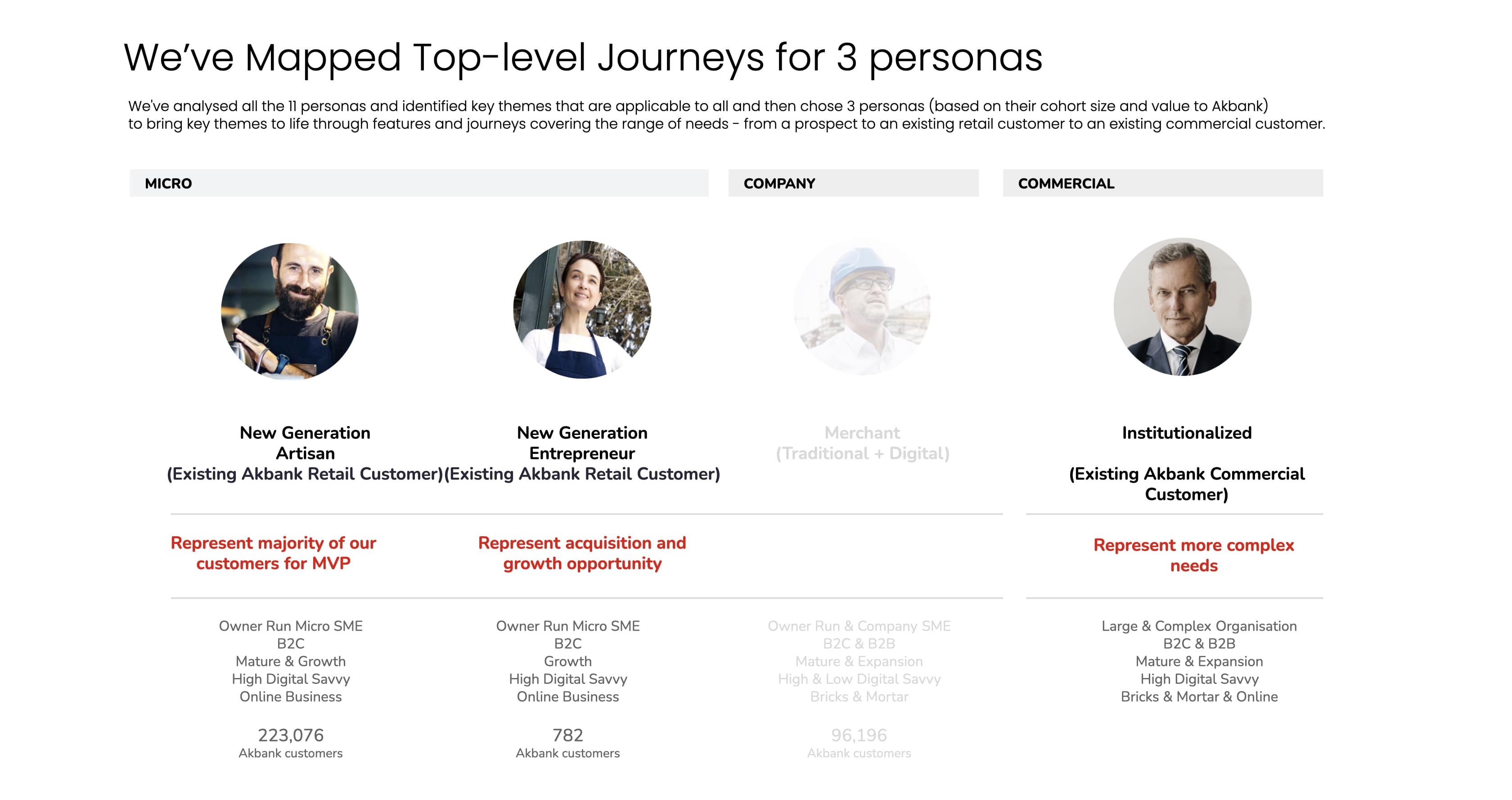

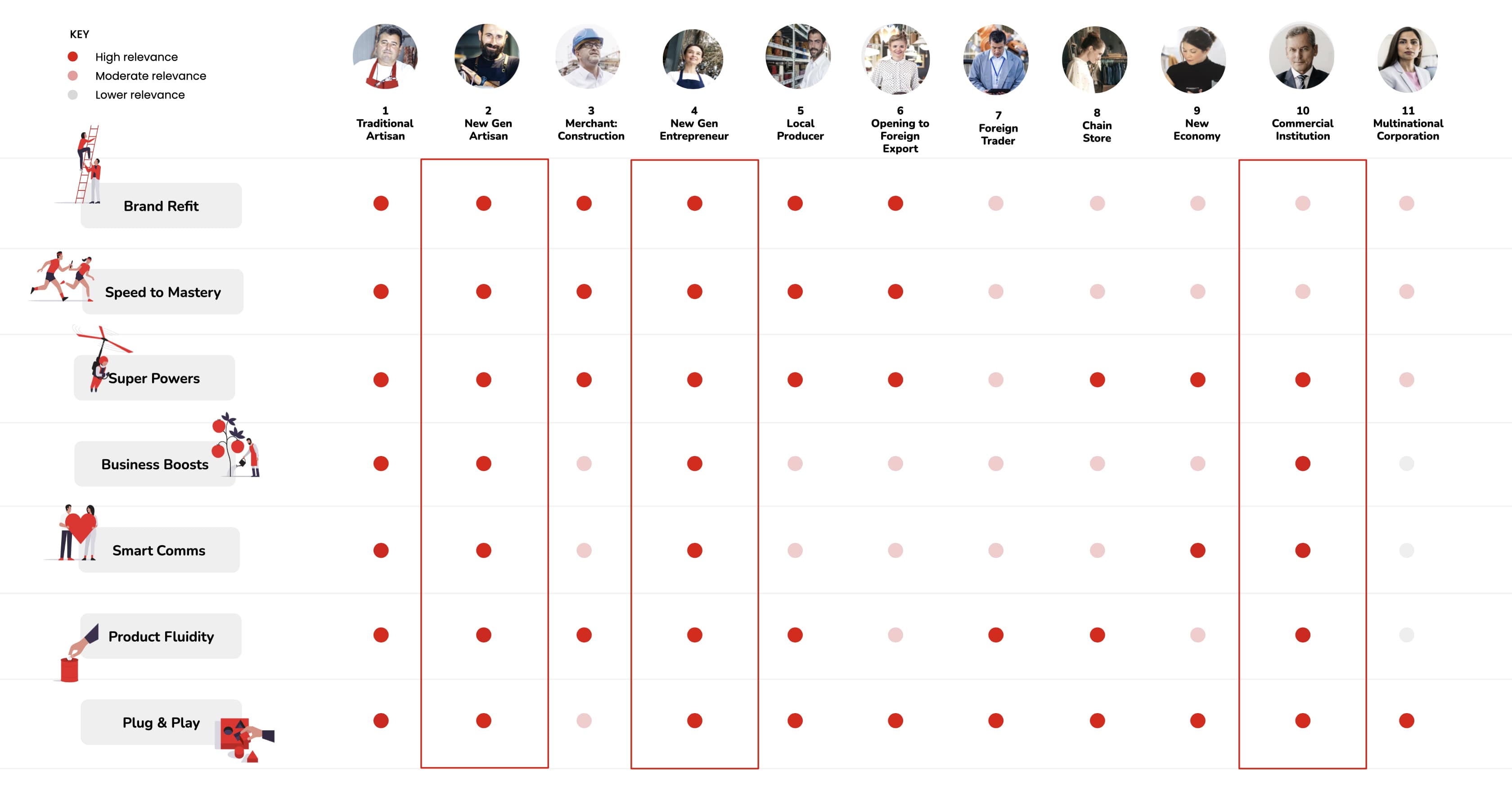

We got to know our Personas

During our research phase we spent some time understanding common themes and needs for all users, prioritising the ones to design for, covering the key needs that work across all. We created design briefs from the users point of view, keeping the users in the room while we designed.

We mapped Jobs To Be Done to customer journeys

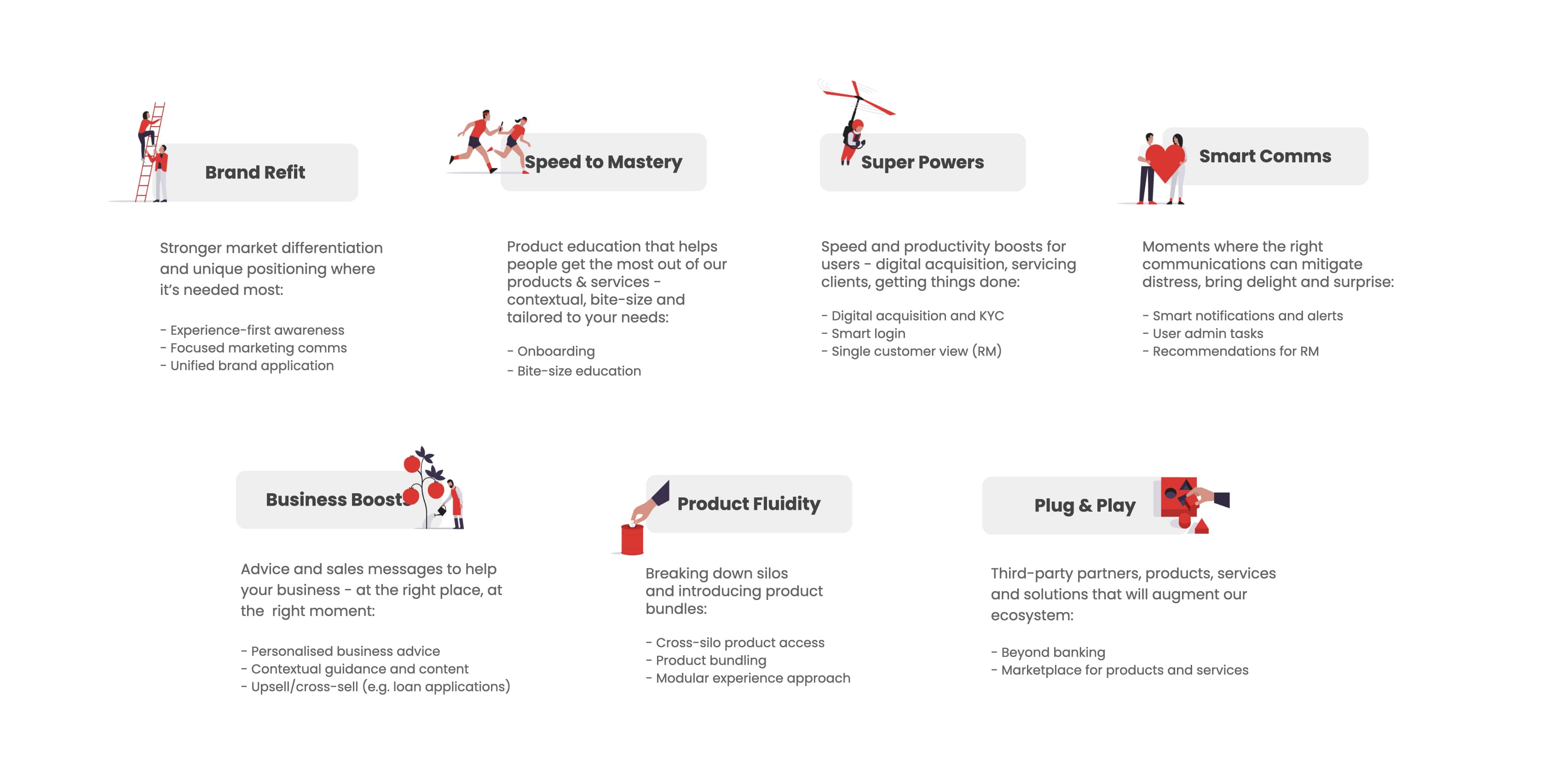

Once, we had a good grasp of our personas we did a workshop with the client to create distinct opportunities to make the greatest impact for each of them. As we were moving along, we started seeing common themes emerge.

We brought the JTBD to life

After the workshop, we ideated for each persona, designing for the user first. We mapped customer channel + staff channel implications to create a connected journey.

Prioritised initial Ideas

We collaborated with the Akbank Core Team to prioritise all these ideas based on desirability, viability and feasibility. It helped us refine the focus areas, to ensure the greatest benefit to the business and the customer.

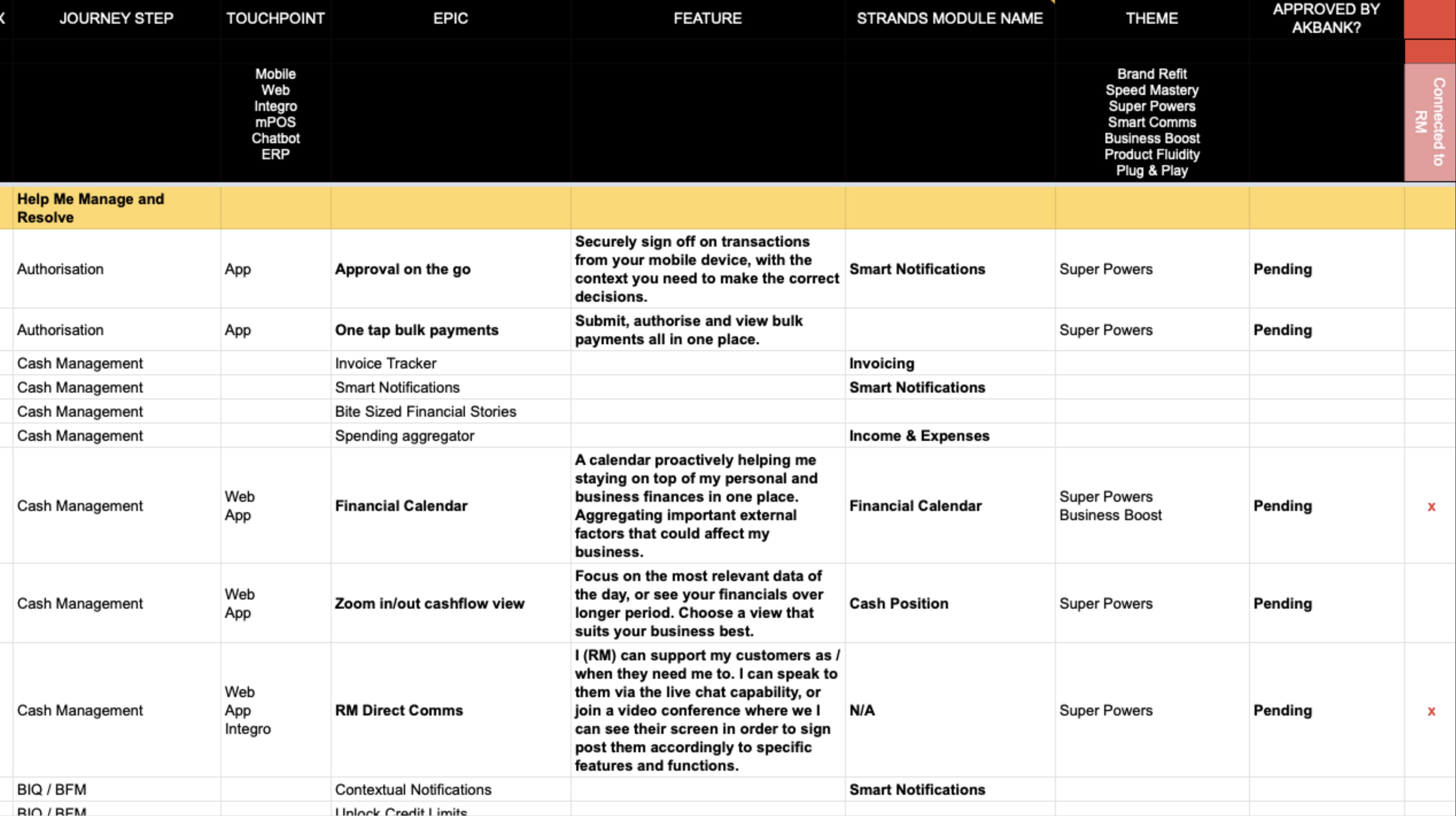

Created a feature list

On the back of this collaboration we created a feature backlog to categorise each feature, which we maintained and updated with each sprint throughout definition.

DEFINTION PHASE

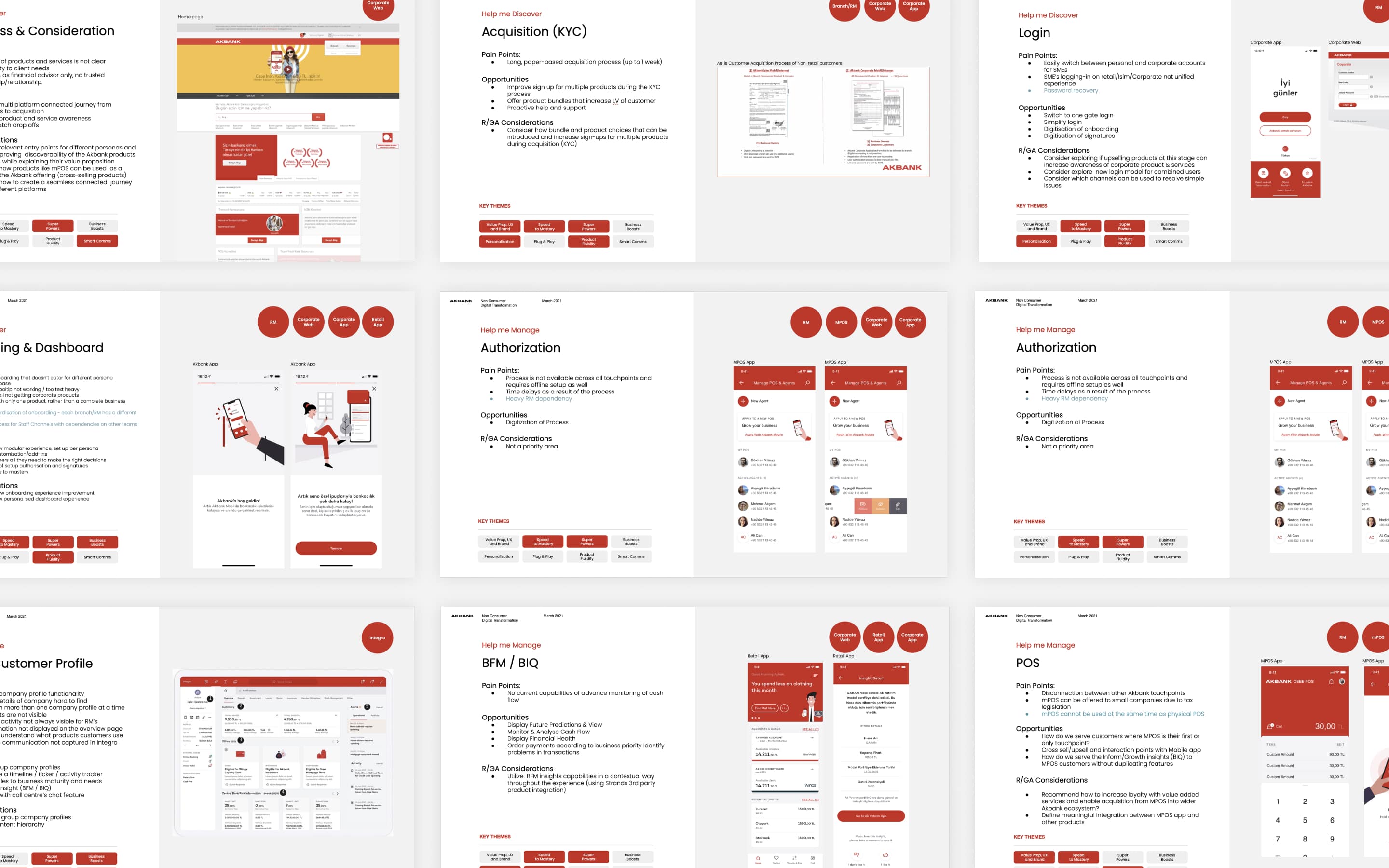

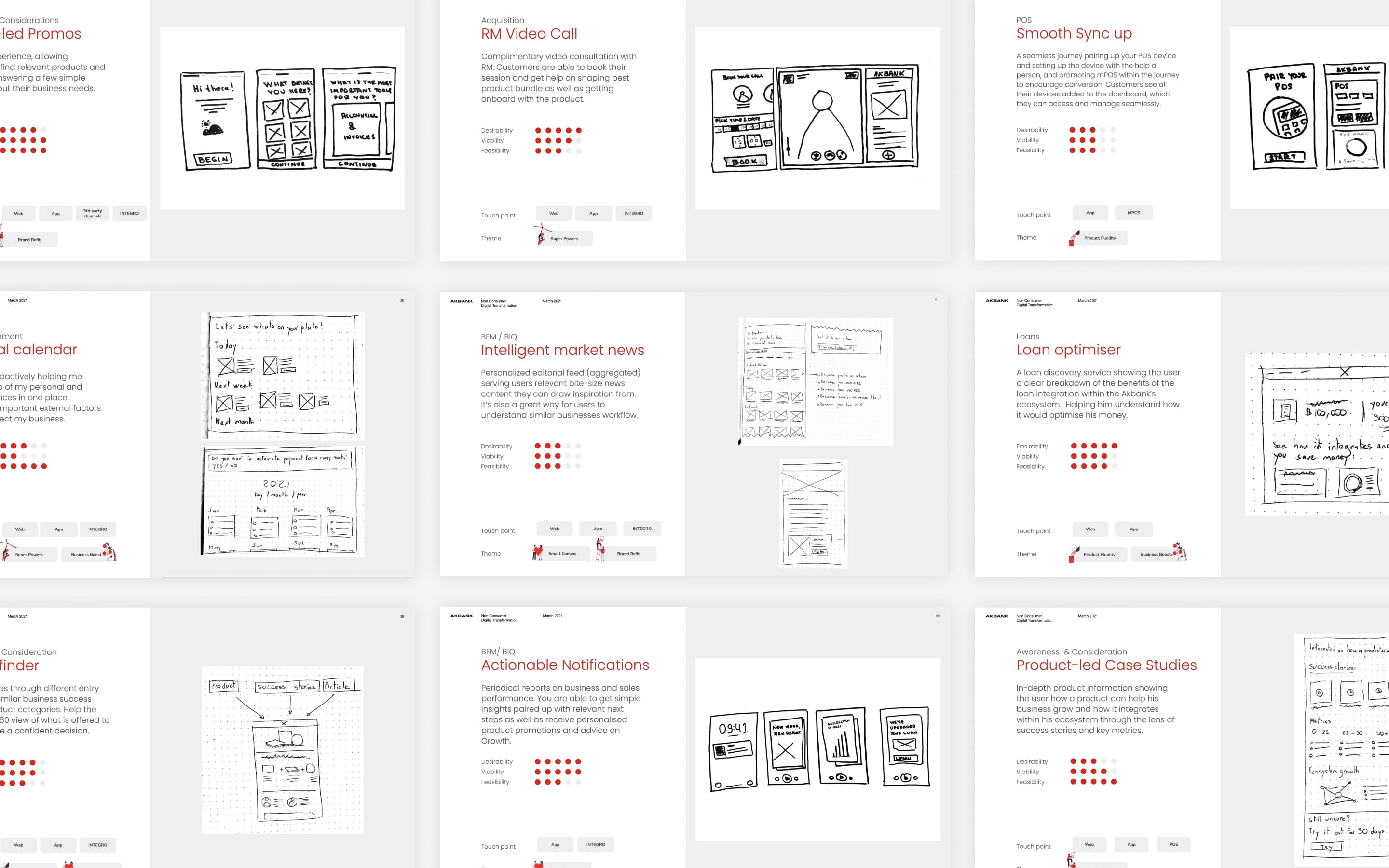

Based on the Discovery insights and outputs we defined a number of priority areas in 2 sprints.

Golden Paths

We started by creating golden paths for our personas, including persona overview, journey steps/ storyline and selected concept screen/ modules mock up. This work was the base of our vision for the target state.

After reviewing and agreeing on the journeys with the client, we decided to focus on specific key areas we wanted to deep dive in...

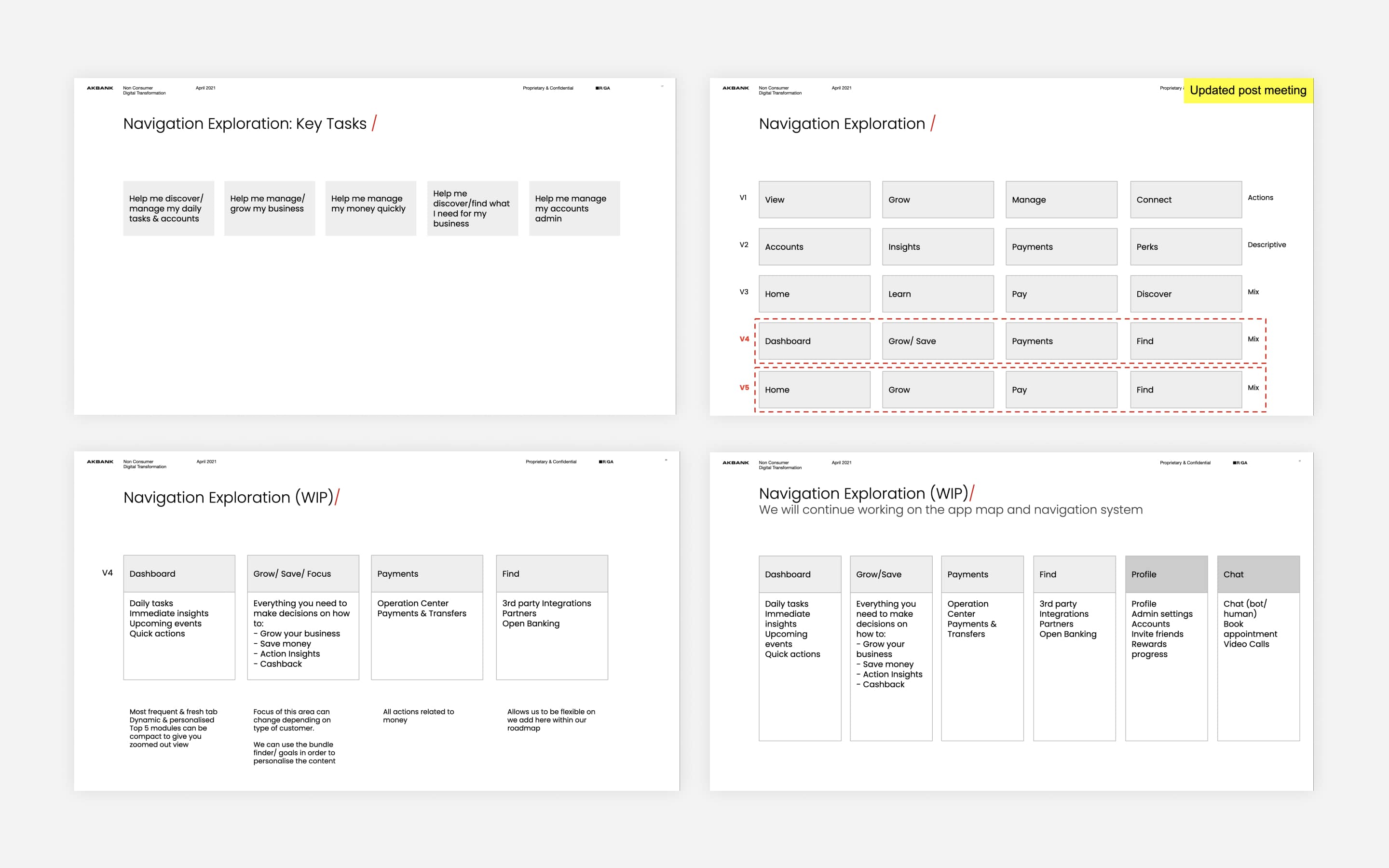

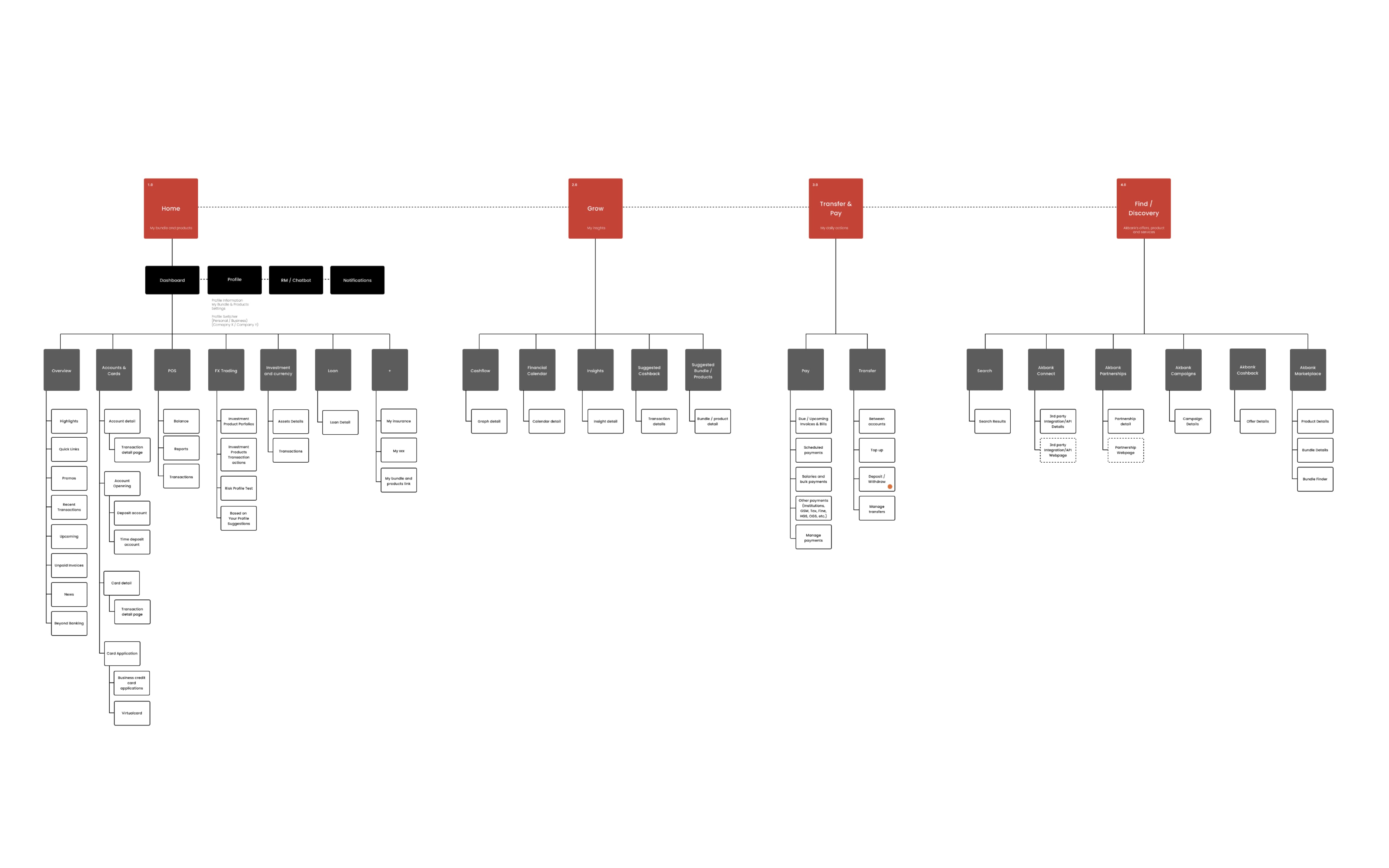

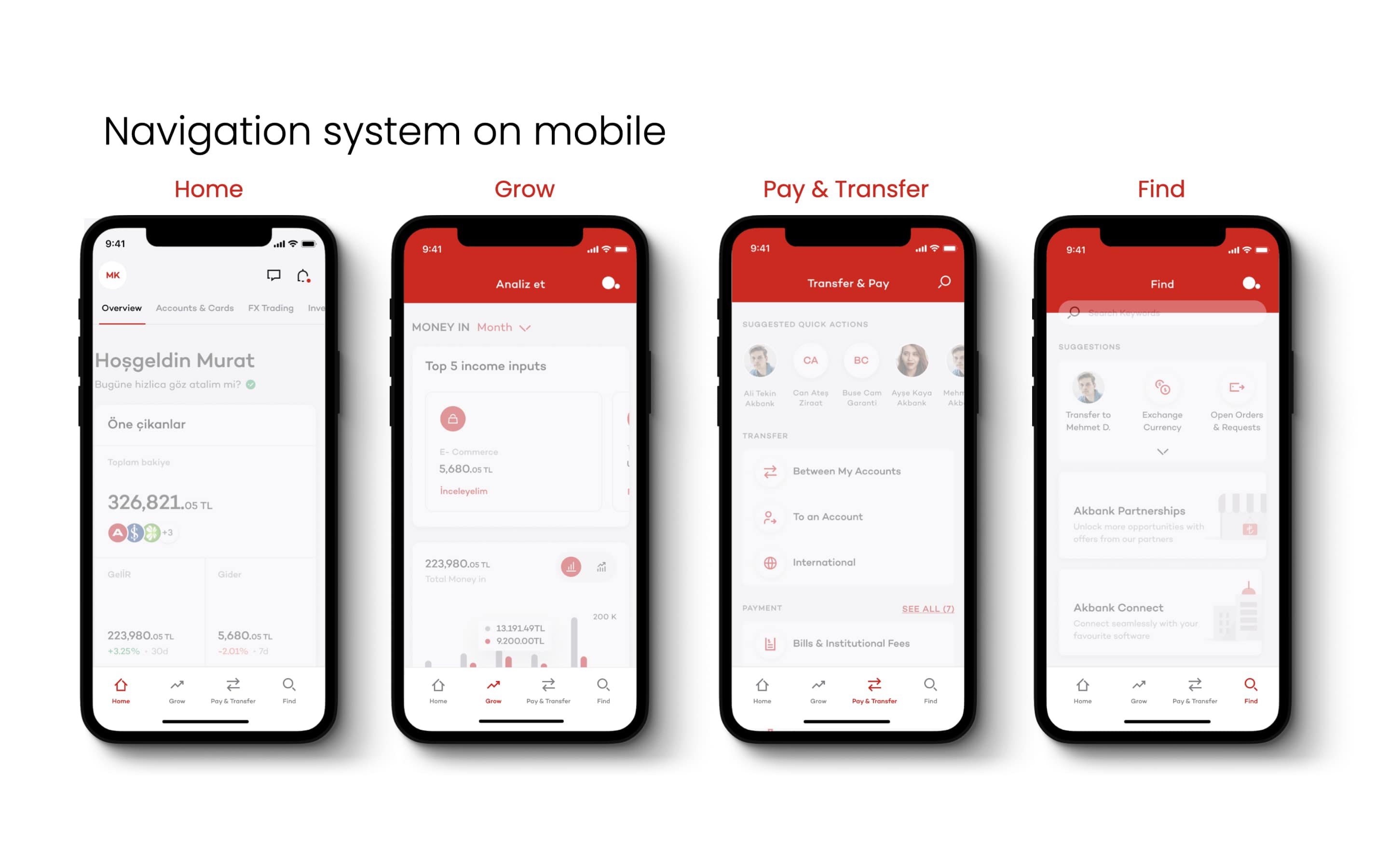

Sitemap & Navigation Exploration

We created a hierarchy content map for existing app and web experience, and from there, built something more dynamic, active and personal. In order to organise a new navigation system, we looked into the tasks & responsibilities our personas go through.

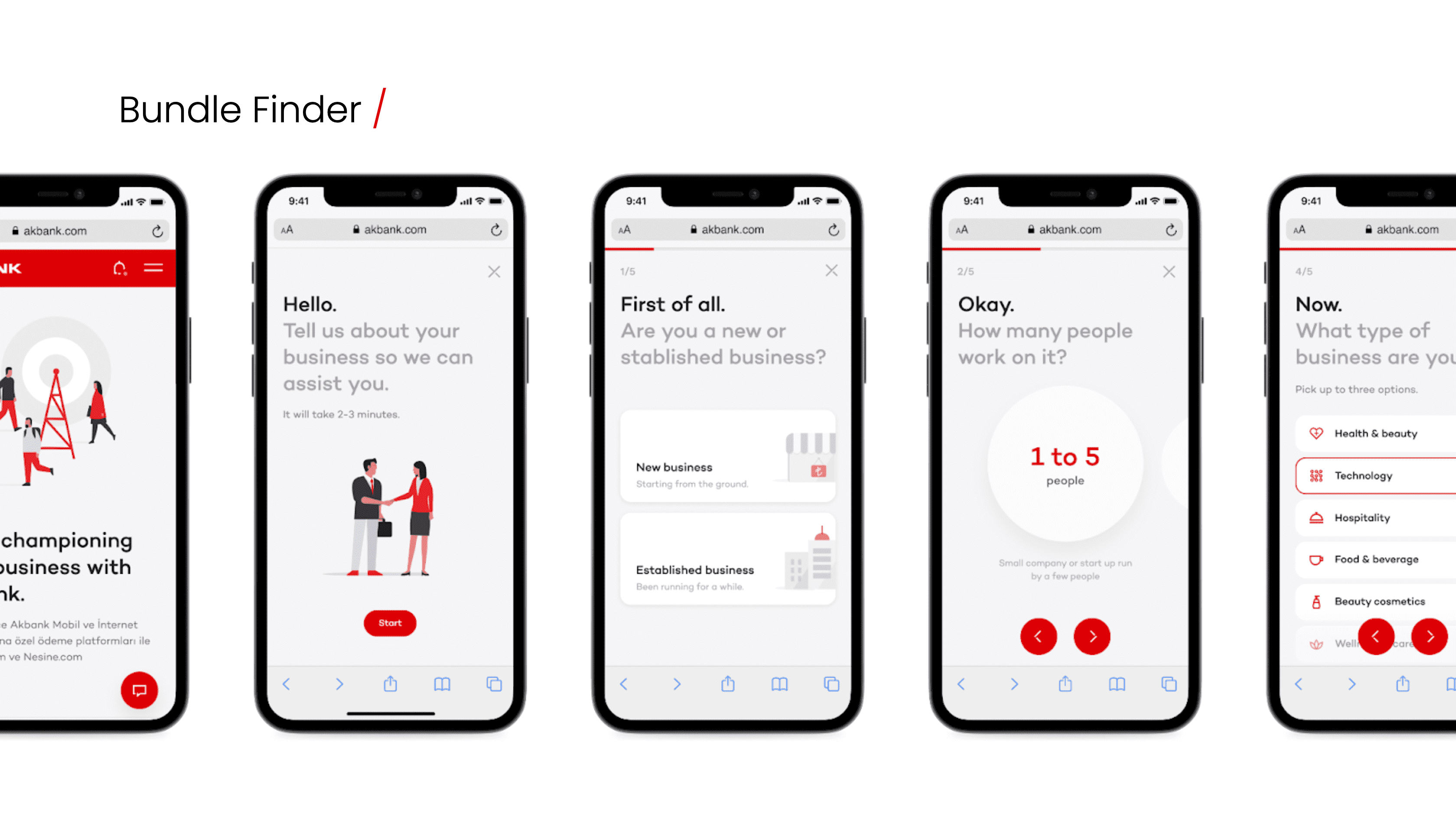

Bundles

We worked on a new bundle logic, human centered, simple and scalable. To do so we focused on the following criteria:

- People should be able to quickly understand bundles through their value and cost

- People should have the power to change bundles to fit their business needs

- People should be able get recommendations through the guided experience.

We made a questionnaire that helps Akbank understand customer’s business needs in order to recommend the right products and start personalising their app experience.

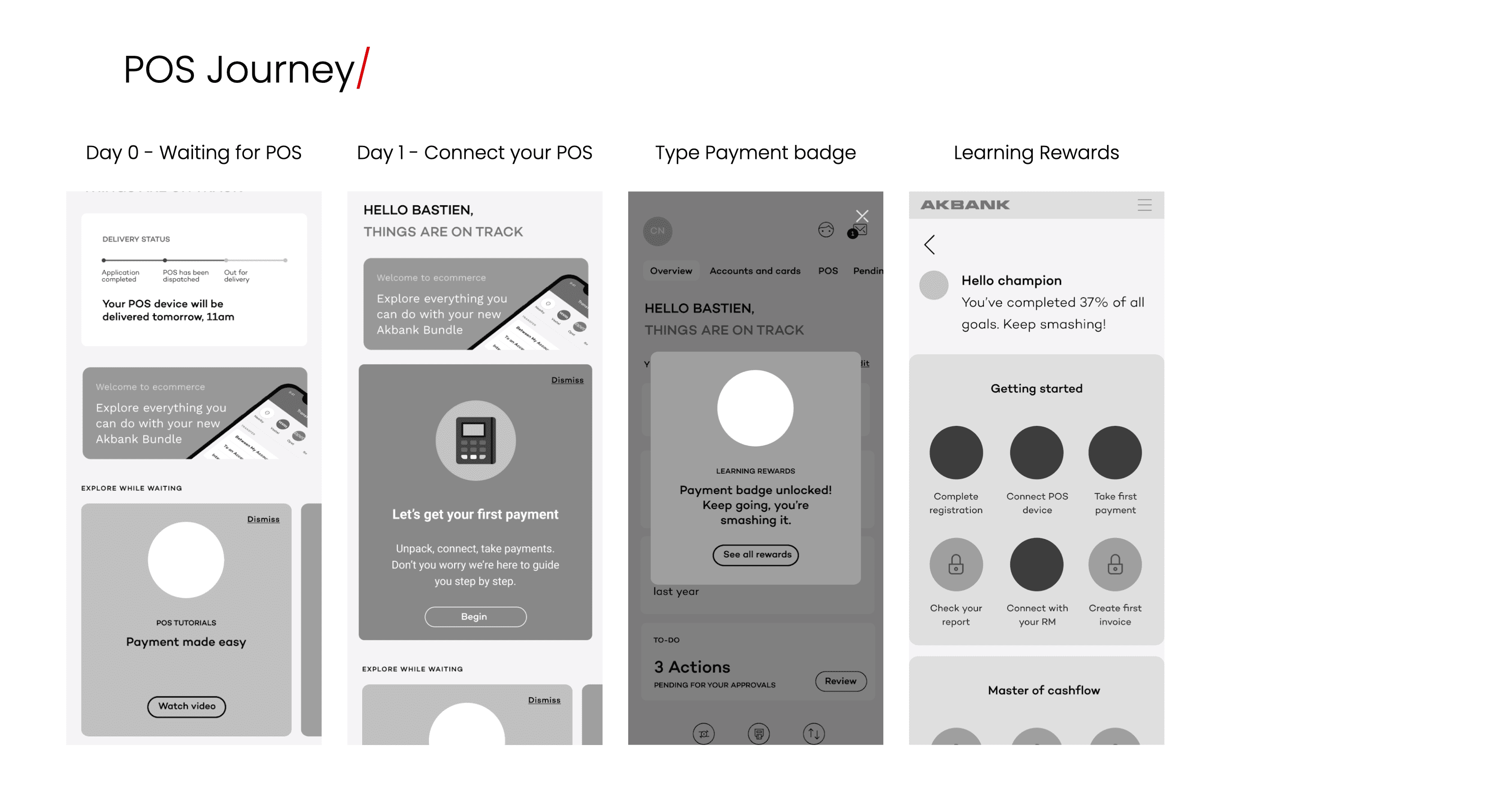

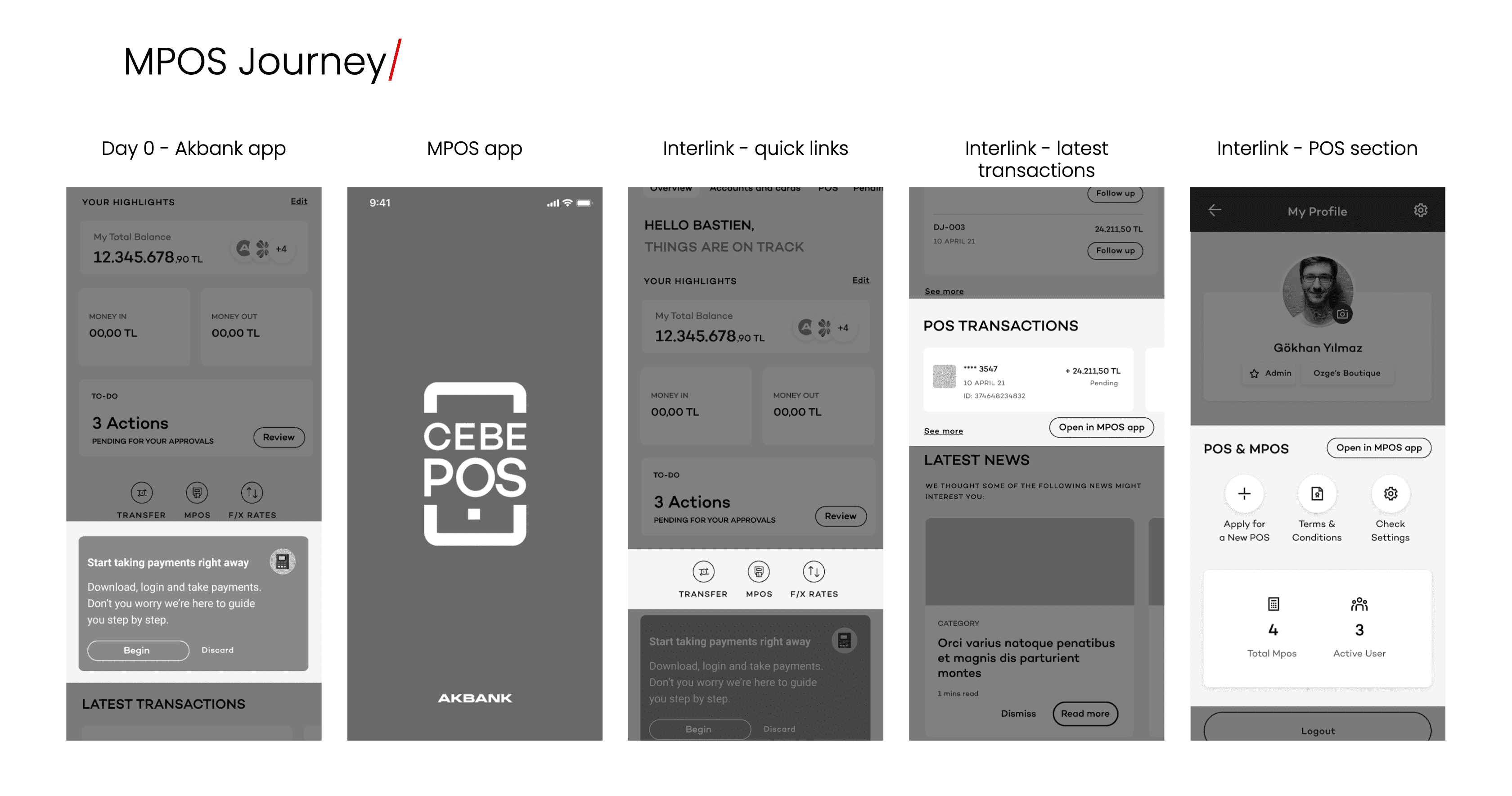

POS and mPOS

For the POS stream of work, we focused on empowering the user throughout the experience, from enabling them to explore POS while waiting for the delivery of the device to guiding them through getting their first payment. We also implemented a reward system to push them to explore and learn about all the different functionalities.

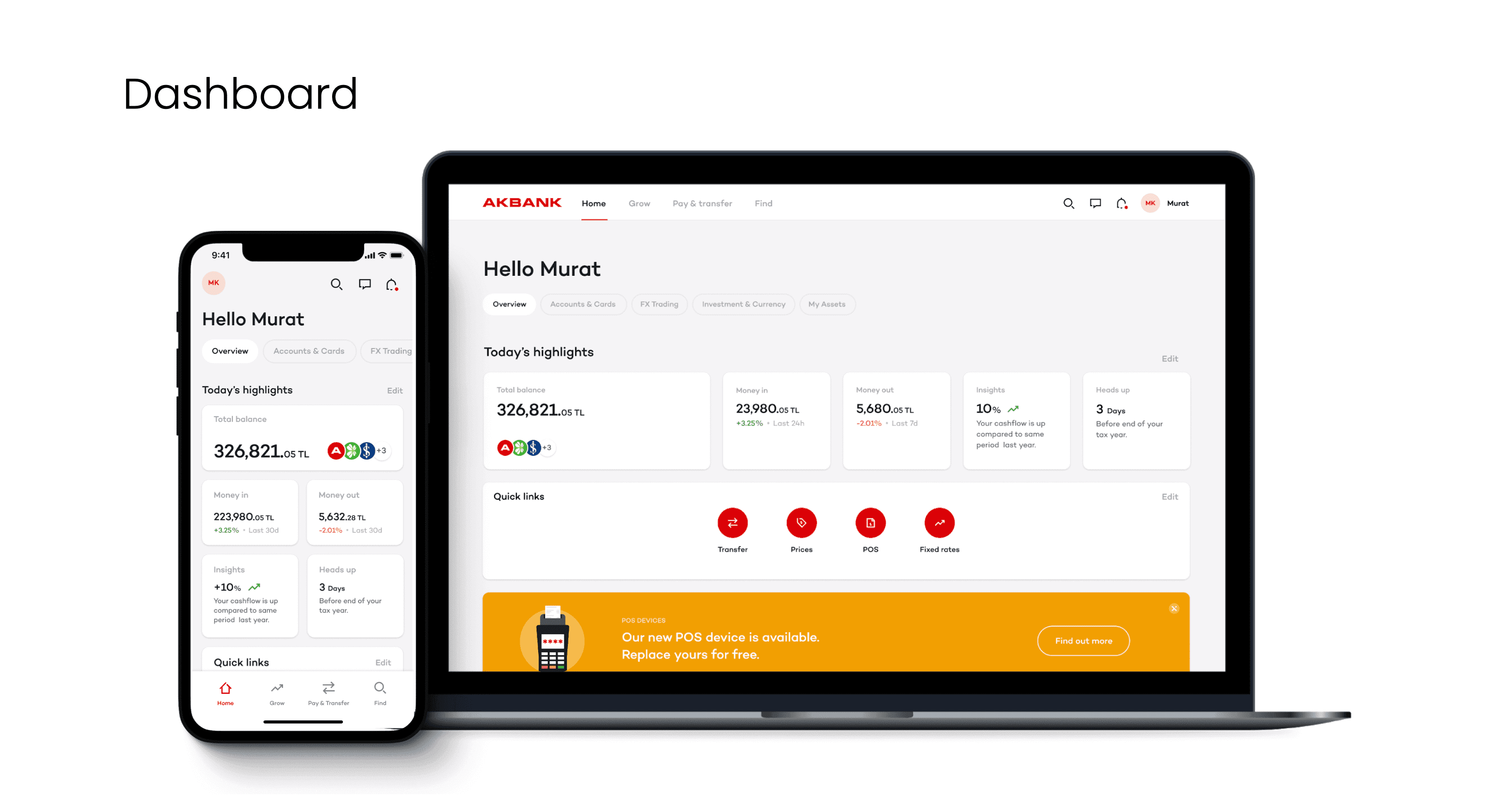

Dashboard

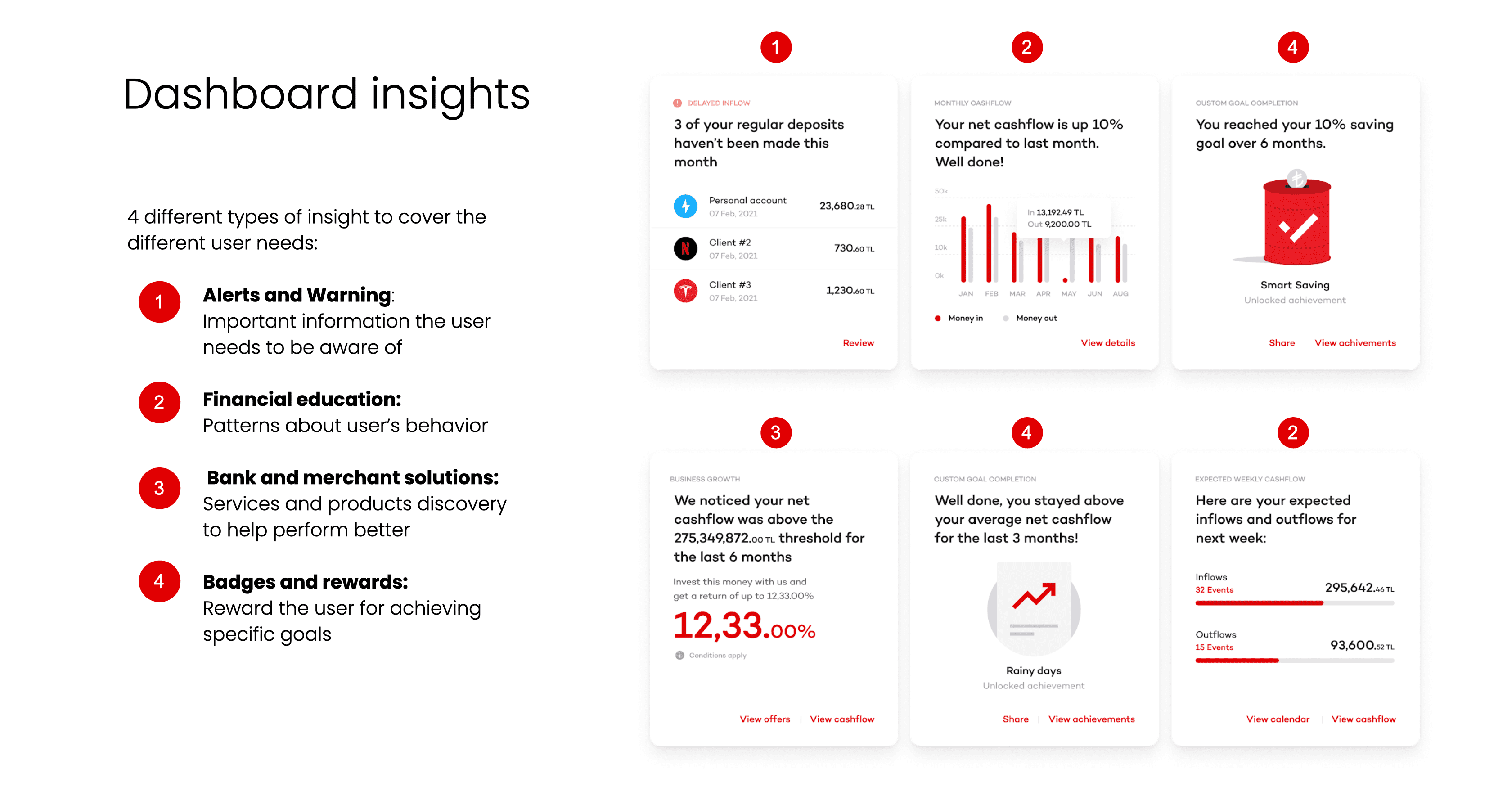

The dashboard offers modules tailored to the user type in order to serve the customer better. It's structured to let the user visualise his "company health" at a glimpse on mobile and desktop. Some critical modules also allow customisation to fully adapt to the user need.

One of the main strength of the dashboard is to display insights to the user through 2 different lenses: General insights about various topics including spending, customer, payment, ... and contextual insights attached to a specific module giving related tips.

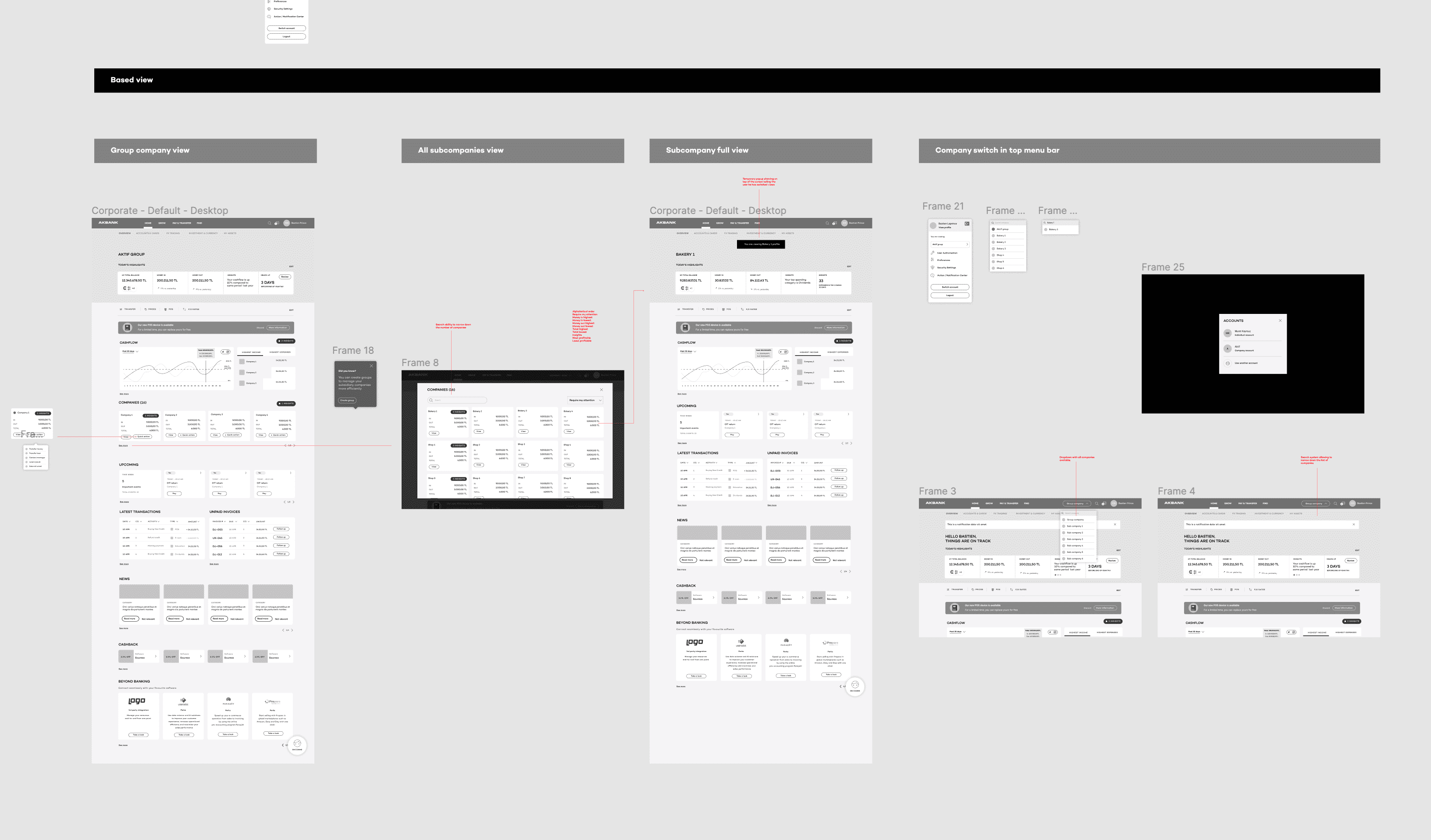

Group Company Profile

Creation of a system to let group companies manage their businesses easily. We worked around a principle of zooming in and zooming out, going from global performances of the group to checking the health of all the subsidiary companies individually.

Following some user research documents, we also allowed the user to cluster subsidiary companies and track/ manage their financial progress through tailored reports.

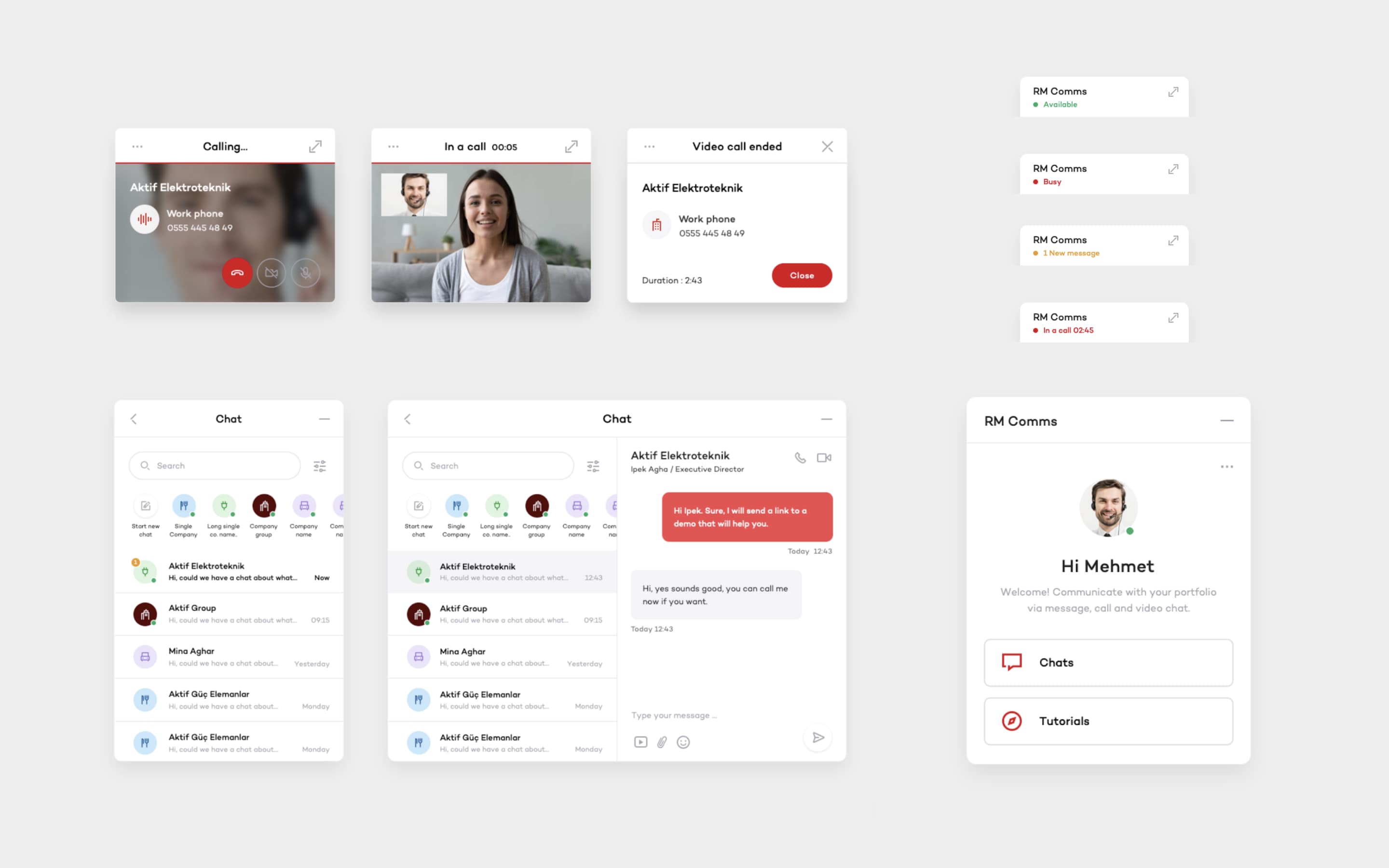

RM Comms

A feature merging existing Call Centre and Akbank Assistant chatbot to serve the user in a more meaningful way. The service allows the user to connect directly with their Relationship Manager. It creates a deeper connection between the customer and RM, by allowing document sharing, video chat, Live app demo, as well as booking an appointment.

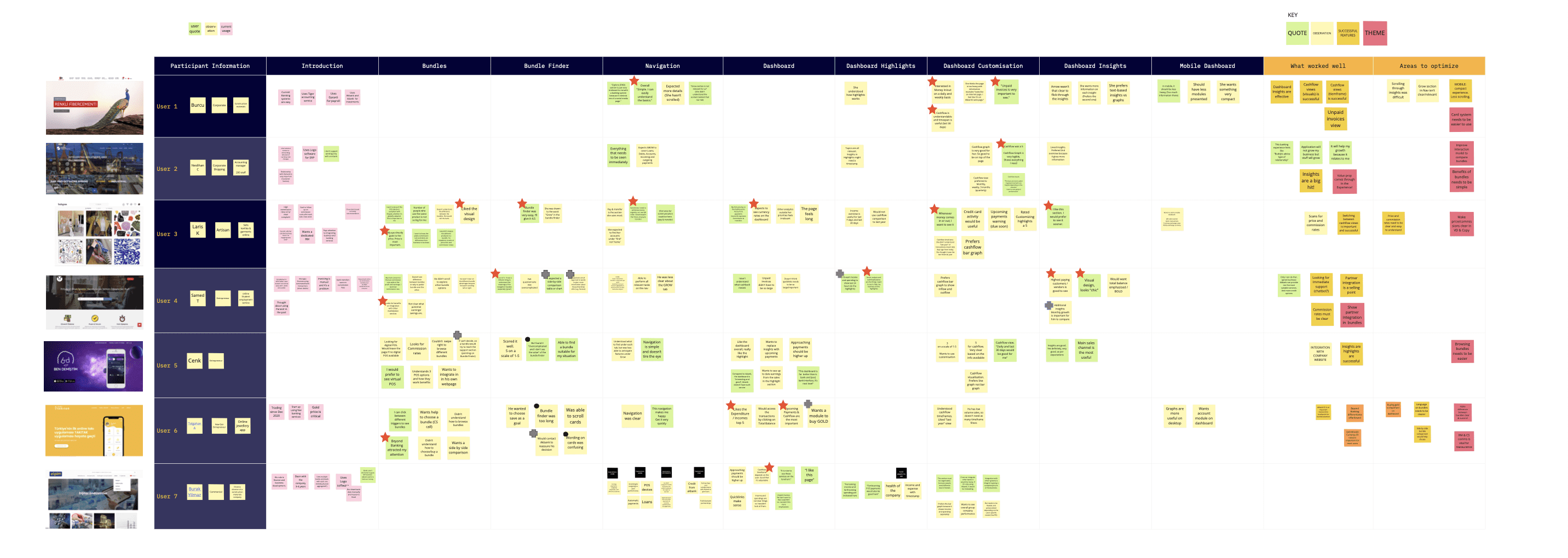

After exploring all these key areas, we went through a round of remote user testing to validate designs and uncover opportunities. It helped us optimize feature concepts and key touchpoints within the scope for customer and staff channels.

Through a series of qualitative interviews with SME and Commercial customers and RMs, we tested specific areas of the new designs that were developed in the Definition phase to gather feedback to inform further iterations.

Finally, we compiled the work produced over 4 months and handed over our recommendations to Akbank, so they can move the project forward into Production and develop the ideas further.